39+ mortgage insurance tax deductible 2021

However higher limitations 1 million 500000 if married. Be aware of the phaseout limits however.

Pdf Social Diagnosis 2011 Objective And Subjective Quality Of Life In Poland Full Report Irena Elzbieta Kotowska Academia Edu

Web Mortgage interest.

. Insurance other than mortgage insurance premiums including fire and comprehensive coverage and title insurance. Connect Online for Tax Guidance. Most state and local tax.

Ad Ask a Tax Expert About Tax Deductible Limits. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

Web You can reduce the taxes you owe by deducting health insurance premiums youve paid beyond the 75 threshold of your adjusted gross income AGI. Complete Edit or Print Tax Forms Instantly. You can deduct amounts you paid for qualified mortgage insurance premiums on a reverse mortgage.

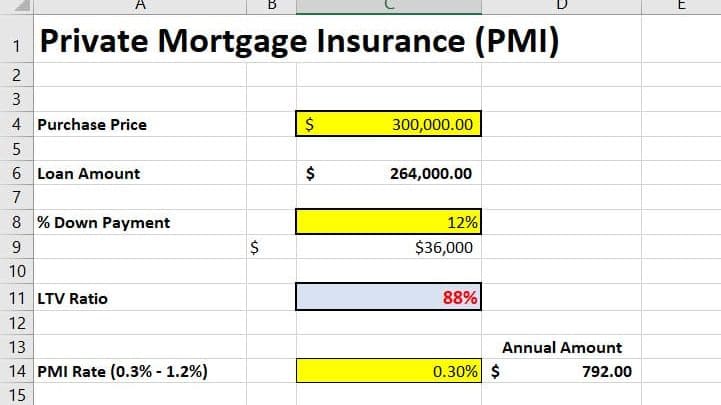

Web The tax deduction for PMI was set to expire in the 2020 tax year but recently legislation passed The Consolidated Appropriations Act 2021 effectively. Ad Access IRS Tax Forms. So if you have a mortgage.

But for loans taken out from. Web The mortgage interest deduction allows you to reduce your taxable income by the amount of money youve paid in mortgage interest during the year. 12950 for single and married filing separate taxpayers.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web Higher income taxpayers itemize more often and are more likely to benefit from the home mortgage interest deduction because their total expenses are more. Web If your adjusted gross income is above a specific amount the ability to deduct your mortgage insurance diminishes.

For tax years before 2018 the interest paid on up to 1 million of acquisition. This means the actual taxes paid or withheld from Jan. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly.

Web The deduction is based on the taxes paid during the tax year. This account is also used to pay homeowners and mortgage. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Web What is the maximum mortgage interest deduction for 2021. Web June 5 2019 1201 PM. Web According to the IRS mortgage insurance premiums are tax deductible for amounts that were paid or accrued in 2021.

Web The PMI Deduction will not been extended to tax year 2022. Connect Online Anytime for Instant Info. Prior tax years Mortgage Insurance Premiums you paid for a home where the loan was secured by your first or.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Ask a Verified CPA How to Benefit from Tax Deductibles.

Web You cant deduct any of the following items. Web The IRS places several limits on the amount of interest that you can deduct each year. Discover Helpful Information And Resources On Taxes From AARP.

Ad Taxes Can Be Complex. Web The property tax deduction can be beneficial to homeowners though tax laws have changed. After this the deduction will not be available.

In your case this would be the. Web For the 2022 tax year meaning the taxes youll file in 2023 the standard deduction amounts are. Web If you pay taxes on your personal property and real estate that you own you payments may be deductible from your federal income tax bill.

That means this tax year single filers and married couples filing jointly can deduct the interest on up. Ad Taxes Can Be Complex. Web In December 2021 the Middle Class Mortgage Insurance Premium Act again sought to make the deduction permanent along with increasing the income.

These are the AGI limits to consider. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

Ev Energy Credits New Tax Deductions

Free Legal Assistance Available For Pennsylvania Remnants Of Hurricane Ida Survivors Helpline 877 429 5994 Legal Aid Of Southeastern Pennsylvania

Bernstein Realty Har Com

Mortgage Interest Deduction How It Calculate Tax Savings

Homeownership After The Tax Cuts And Jobs Act The Cpa Journal

Calameo Acar 2021 Annual Report

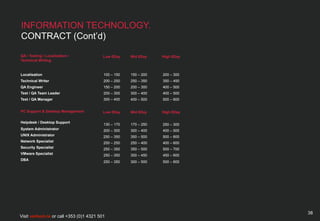

Salary Guide 2010

Do Conditional Cash Transfers For Schooling Generate Lasting Benefits Request Pdf

Home Mortgage Loan Interest Payments Points Deduction

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Is Mortgage Insurance Tax Deductible Bankrate

Is There A Mortgage Insurance Premium Tax Deduction

India Herald 111115 By Fort Bend Independent Issuu

Free Legal Assistance Available For Pennsylvania Remnants Of Hurricane Ida Survivors Helpline 877 429 5994 Legal Aid Of Southeastern Pennsylvania

Is Pmi Mortgage Insurance Tax Deductible In 2022 Refiguide Org Home Loans Mortgage Lenders Near Me

How To Calculate Private Mortgage Insurance Pmi Excelbuddy Com

Uct Undergraduate Prospectus 2017 By Uct Careers Issuu